Fica Limit 2024 Maximum

Fica Limit 2024 Maximum. A wage base limit applies to employees who pay social security taxes. What is the maximum income subject to fica tax for 2024?

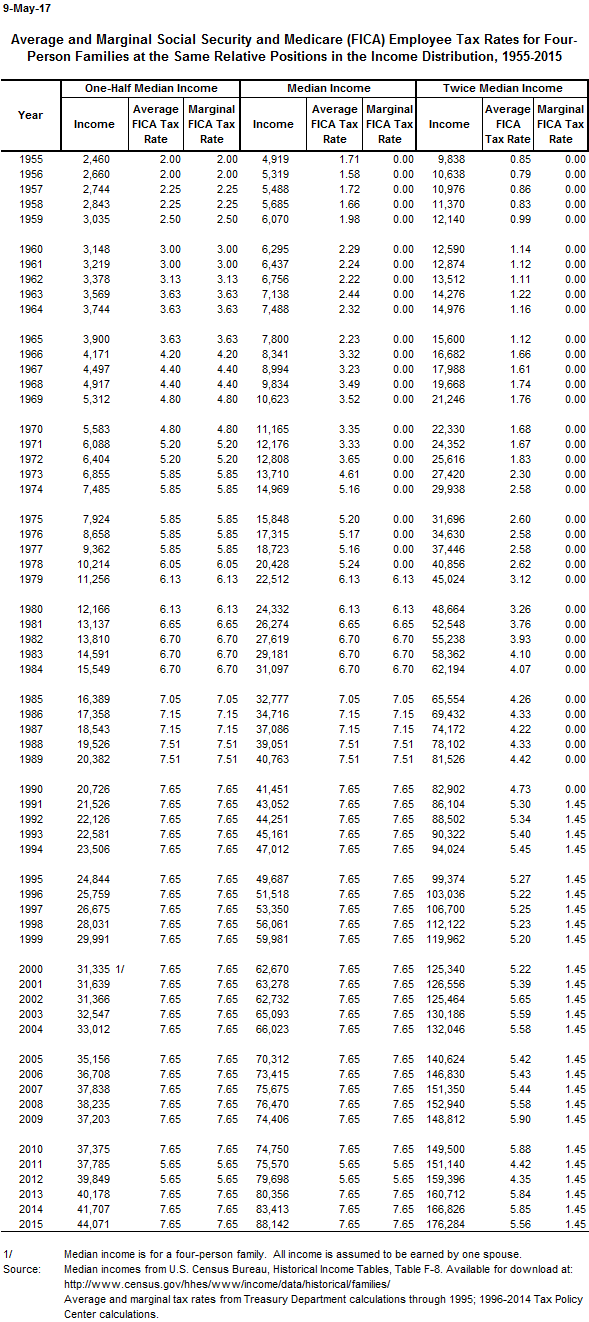

Social security tax (6.2% of wages, up to a maximum taxable income) and medicare tax (1.45% of wages, with no. The maximum fica tax rate for 2024 is 6.2%.

(For 2023, The Tax Limit Was $160,200.

The deduction applies to a basket of investments and.

For 2024, The Social Security Tax Limit Is $168,600 (Up From $160,200 In 2023).

The taxable wage base estimate has been released, providing you with key numbers.

Fica Limit 2024 Maximum Images References :

Source: salliewtalya.pages.dev

Source: salliewtalya.pages.dev

Irs Fica Limit 2024 Carin Cosetta, What is the maximum fica taxable income amount? A wage base limit applies to employees who pay social security taxes.

Source: www.mortgagerater.com

Source: www.mortgagerater.com

FICA Limit 2024 How It Affects You, Once an employee’s salary reaches that limit, they are no longer required to pay this tax. 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20;

Source: www.mortgagerater.com

Source: www.mortgagerater.com

FICA Limit 2024 How It Affects You, Federal insurance contributions act (fica) changes. Once an employee’s salary reaches that limit, they are no longer required to pay this tax.

Source: glynisqshanon.pages.dev

Source: glynisqshanon.pages.dev

Maximum Social Security Withholding 2024 Dani Millie, Here's everything you need to know. The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2023.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Max Social Security Tax 2024 Withholding Table Reyna Clemmie, The social security wage base has increased from $160,200 to $168,600 for 2024, which increases the maximum. In 2024, the social security tax limit rises to $168,600.

Source: rosaliewviki.pages.dev

Source: rosaliewviki.pages.dev

State Withholding Tax Table 2024 Sari Winnah, The taxable wage base estimate has been released, providing you with key numbers. The wage base limit is the maximum wage that's subject to the tax for that year.

Source: www.mortgagerater.com

Source: www.mortgagerater.com

FICA Limit 2024 How It Affects You, The taxable wage base estimate has been released, providing you with key numbers. Social security maximum taxable earnings 2024 diann florina, the maximum amount of earnings subject to the social security tax (taxable maximum) has increased to $168,600.

Source: suzettewastrid.pages.dev

Source: suzettewastrid.pages.dev

Fica Salary Limit 2024 Amye Kellen, The rate is for both employees and employers, according to the internal revenue code. Federal insurance contributions act (fica) changes.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

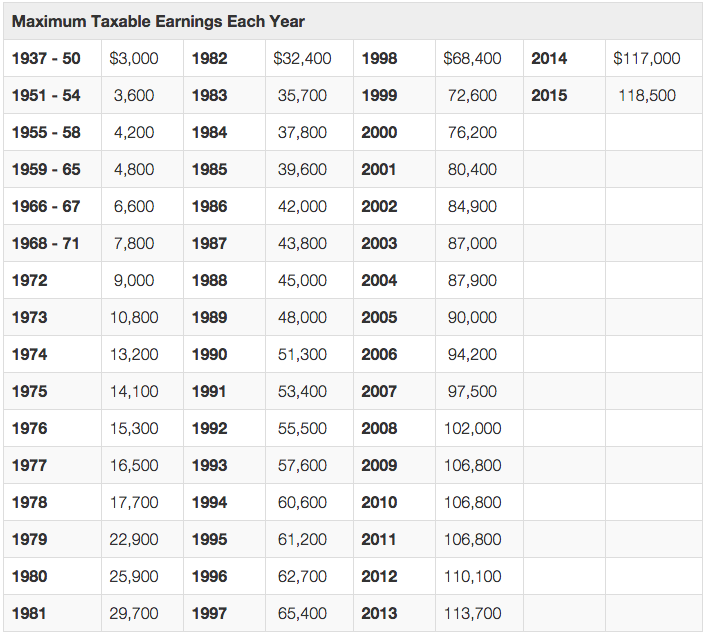

Maximum Taxable Amount For Social Security Tax (FICA), Social security limits the amount of income subject to taxation. This means that gross income above a certain threshold is exempt from this tax.

Source: erenaqhedvige.pages.dev

Source: erenaqhedvige.pages.dev

Fica Max 2024 Berta Vivianna, Social security tax rate for 2024: So, if you earned more than $160,200 this last year, you didn't have to pay.

6.2% Social Security Tax On The First $168,600 Of Employee Wages (Maximum Tax Is $10,453.20;

The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2023.

(For 2023, The Tax Limit Was $160,200.

6.2% for both the employer and the employee.

Posted in 2024